As consumers’ lifestyles, preferences, and expectations change, financial institutions must adapt and adjust to meet these changes. Historically, financial institutions have done seemingly everything possible to eliminate personal contact with the customer. From drive-up windows to ATMs, from telephone banking to internet banking, financial institutions have become faceless entities. Add to that the onslaught of new traditional and non-traditional types of competition, and you will see that the need to differentiate your institution and improve product and service delivery becomes paramount.

Retailers Meet Changing Consumer Demand

Retailers play an important role in the lifestyles and are a frequent destination of consumers. Retailers themselves have been leaders in adapting and adjusting to the changing demands of consumers. More and more, these facilities are becoming “one-stop” facilities by offering ever expanding products and services. In-Store Financial Centers deliver an increasingly important and decreasingly available opportunity: personal contact with current and potential customers.

The opening and operating of an In-Store Branch is a powerful and visible commitment from your institution to expand and improve upon your product delivery system. Your institution will be better able to serve existing customers, while realizing tremendous new opportunities to market and sell. In the ongoing and increasingly competitive battle for market share, your In-Store Branch will play a vital role in solidifying existing customer relationships and attracting new and profitable business.

In-Store is the Face of Your Financial Institution

Advantages of adopting an In-Store banking program:

- Growth

- Built in target market

- Cost Effective

- Frequency of shoppers

- Convenience

- More face-to-face contact

Strategic purposes for each specific In-Store location:

- Growth-agent for the financial institution

- Offset the client transaction volume of a local traditional branch

- Strategic move to prevent a competitor from entering the market

- Become an innovative leader

- Improved client satisfaction and convenience

Difference Between Traditional and In-Store Locations

In-Store associates are cross-trained to be full-service agents while traditional employees are compartmentalized specialists in a specific area.

- In-Store associates have access to more potential customers on a daily basis.

- The primary purpose of the retail shopper is to shop; not necessarily to conduct financial transactions. People entering a traditional branch are either current clients wishing to conduct financial business or potential clients on a fact-finding mission.

- The environment of the In-Store Branch is consistently changing and filled with excitement, noise, distractions and a very diverse clientele whereas the traditional branch operates similar to a library.

- In-Store patrons may visit the In-Store Branch or the retail store several times each week versus the traffic patterns of its traditional counterparts. And the foot traffic in traditional branches continue to fall.

Learning to Thrive in a Retail Environment

In-Store associates have the unique opportunity of reaching a larger audience on a daily basis. Therefore, it is critical that each opportunity is a winning one. The In-Store associate should remember that they are always ‘On Stage.’ Shoppers tend to be observant of the branch’s activities and presence within the store. Understanding this dynamic will help you and your In-Store team to communicate a clear message to shoppers and customers/members.

Always Remember to:

- Make eye contact and offer a friendly smile to everyone.

- Enthusiastically greet those who pass or enter your branch.

- Engage everyone in conversation, when possible, before they arrive at your desk or window.

- Engage passersby in conversation at the earliest possible moment.

Number of In-Stores Operating in the United States

According to S&P Global Market Intelligence there are a total of 3,432 In-Store Branches in the United States as of January 2022.

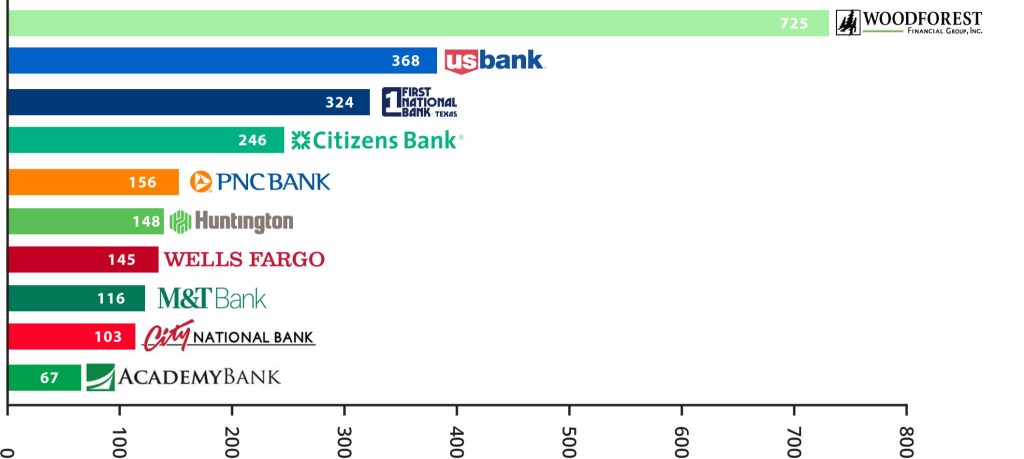

The Largest U.S. In-Store Banks

*All institutions are estimates based on 01/21/22 S&P Global Data

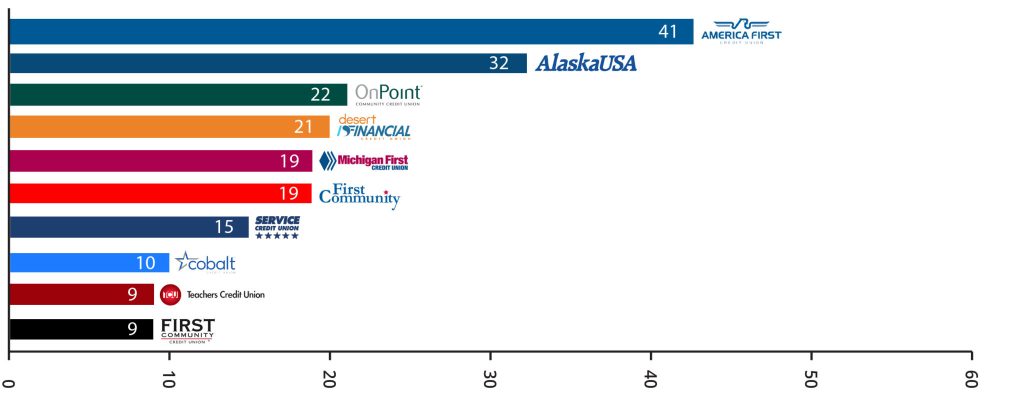

The Largest U.S. In-Store Credit Unions

*All institutions are estimates based on 01/21/22 S&P Global Data

FSI’s In-Store Portfolio

- In-Store

- Storefront

- On-Site

- Branch Transformation

- Traditional

- Teller Assisted

- Cashless

Getting Started: Set Goals

You can’t control what you don’t measure. Whether or not branch activity numbers are used for incentive purposes, it is important that they are measured and charted. Simply, it is extremely difficult to monitor progress without current, relevant, and accurate data. Day-to-day, week-to-week, and month-to-month records of new accounts, teller transactions, loan applications, etc. will give the In-Store Branch, as well as upper management, an understanding of the productivity of the In-Store Branch. These trends will also be invaluable to staff members in monitoring effectiveness of promotions, new marketing efforts, etc.

The following are relevant items to be closely monitored and charted by the financial institution:

- Demand Deposit Accounts

- Savings accounts

- Certificates of Deposit

- Retail employee accounts

- Credit card applications

- Loan applications

- Booked loans

- Teller transactions

- Business Development Activities

- PA Announcements conducted

Executive Goals: Pre-Opening

Prior to the opening of the In-Store Branch a Branch Goals and Expectations Worksheet will be completed by Executive Management. This will provide guidance to your training consultant as they guide your In-Store team toward goal achievement

Executive Goals: Annually

After your first year of operation and annually during the term, your FSI Consultant(s) will review and discuss current Branch Goals and Expectations with executive management prior to the on-site consultation. Based on that review your Consultant will customize the annual consultation agenda for your branch, ensuring performance expectations are met as your program matures. A post-consultation executive summary will be forwarded and reviewed with executive management highlighting results of the consultation and recommendations for continued improvement.

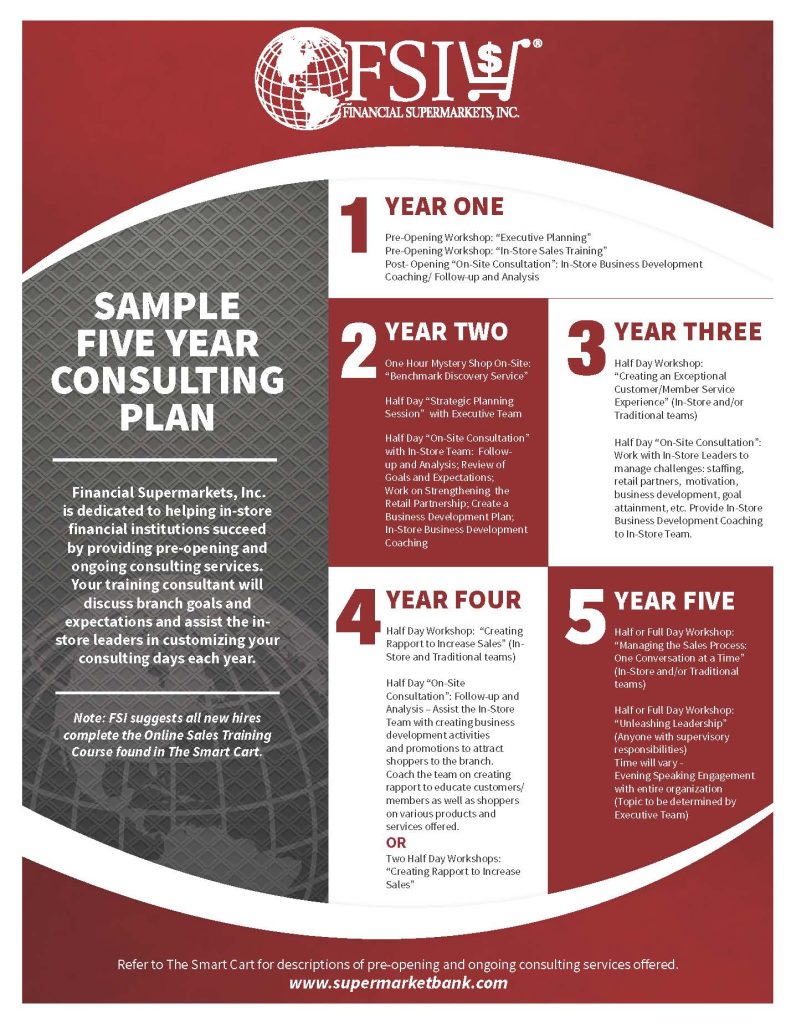

Executive Goals: One to Five Year Plans

In efforts to get the most out of your FSI consulting agreement, your training consultant is available to create a customized One to Five Year Action Plan to include a variation of branch consultations, on-site training workshops, and executive strategic planning sessions. See Five Year Action Plan Sample here.

It’s Time to Start

Wouldn’t it be great if every promotion, personal contact, and marketing attempt worked perfectly? Of course. Will they? Of course not.

What matters most is activity. Success is born from action. It is important to be doing the right things. When you are not busy handling customer transactions or opening new accounts, the team should be focusing on business development activities.

Proactive Attitude, Proactive Actions

The key to the success of an In-Store Branch is the staff’s ability to perform the duties of running a branch, while making widespread, positive contact with store customers. These contacts are geared to attracting new customers and creating new business for the financial institution.

YOU Are Important to Us

The completion of this training session is not an ending. Our commitment to you has just begun. Financial Supermarkets, Inc. is dedicated to the success of your In-Store Branch. Your institution is part of The Supermarket Bank® family. You are important to us!